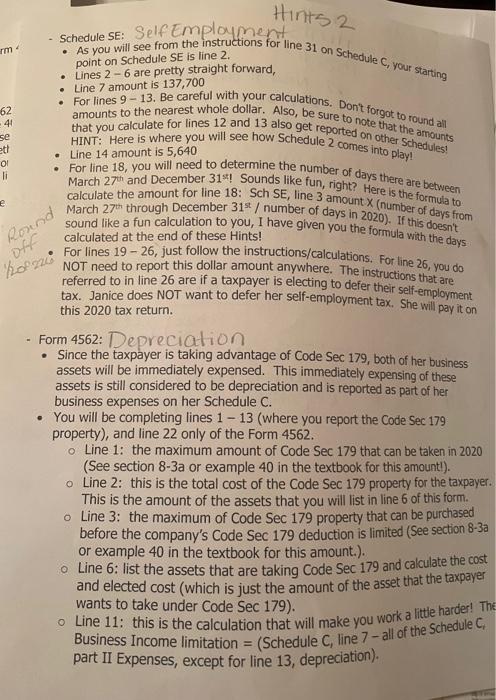

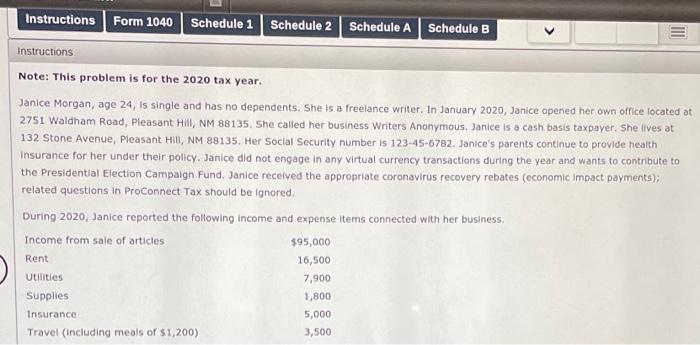

31+ tax form for mortgage interest

Web Youll only use this information for itemized deductions if you decide its more beneficial to take the standard deduction you cant deduct the mortgage interest paid. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

. Ad Fill Sign Email IRS 1098 More Fillable Forms Register and Subscribe Now. Web Download your 1098 Form from Freedom Mortgage. Web About Form 8396 Mortgage Interest Credit.

Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. Ad Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now. Web Determining How Much Interest You Paid on Your Mortgage You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after.

Ad Get Rid Of The Guesswork Have Confidence Filing Tax Forms w Americas Leader In Taxes. Web You or someone on your tax return must have signed or co-signed the loan If you rented out the home you must have used the home more than 14 days during the. Web The 1099 Interest form is typically referred to as the 1099-INT.

Web Is mortgage interest tax deductible. On the form scroll to. Start Today With TurboTax.

Its a tax form used by businesses and lenders to report mortgage interest paid to them of 600 or more. To download a copy log in to your. Ad Need Help Filing Your Tax Return.

Its a document that is sent out and shows how much mortgage interest. Between January 15 2023 and January 31 2023 RoundPoint Mortgage will. If you pay more than 600 in mortgage.

HR Block Offers a Wide Range of Tax Prep Services to Help You Get Your Maximum Refund. Web IRS Form 1098 is a mortgage interest statement. Download or Email IRS 1098 More Fillable Forms Register and Subscribe Now.

In Forms view locate and click on Tax Int Wks on the left from the forms list. Form 1098 is an IRS form used to report mortgage interest during the year. Web Form 1098.

Your 2022 year-end Mortgage Interest Statement will be available by January 31 2023. Web There is a workaround for this. Web A year-end statement also known as IRS tax form 1098 is essentially a status update on a mortgage.

Federal Tax Filing Has Never Been Easier. This document is sent if you had an escrow account that earned 1000 or more in interest throughout the tax year. If you were issued a qualified Mortgage Credit Certificate MCC by a state or local governmental unit or agency under.

Find The Correct Forms You Need to File Your Return. Web If the taxpayer is claiming the mortgage interest credit and you have entries on Screen 382 EIC Residential Energy Other Credits Screen 39 in 2013 and prior. Web Weve made it easy and secure to access your 2022 IRS Tax Forms 10981099 for your tax return.

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Understanding Mortgage End Of Year Tax Forms Santander Bank Santander

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com

Free 31 Credit Application Forms In Pdf

Sec Filing Investor Relations Luther Burbank Corporation

Here S How To Master Your Mortgage With The 1098 Form Pdffiller Blog

Articles Kanakaris Law Firm

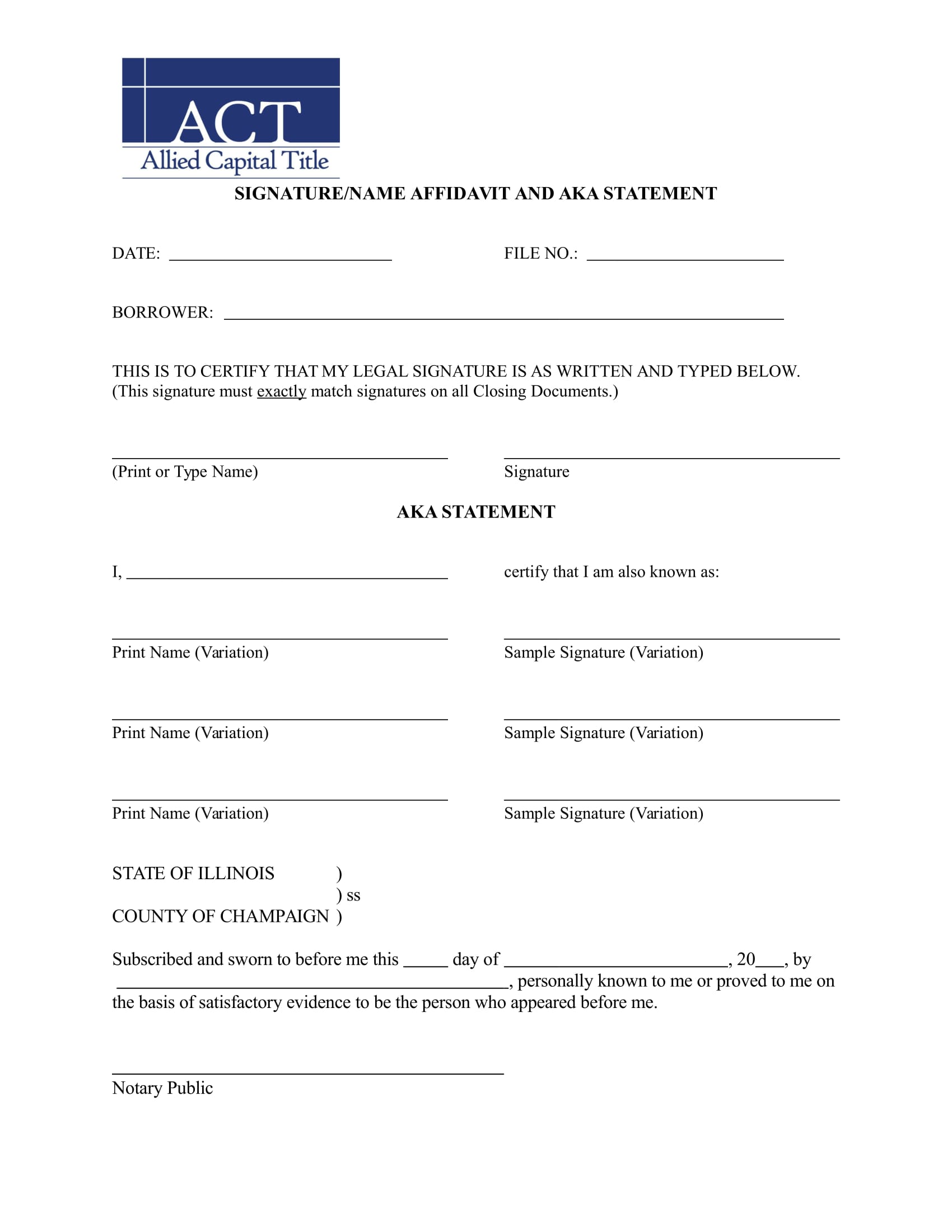

31 Statement Forms In Ms Word Pdf Excel

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com

Lbcinvestorpresentation

Expected Changes To 1098 Mortgage Interest Statement

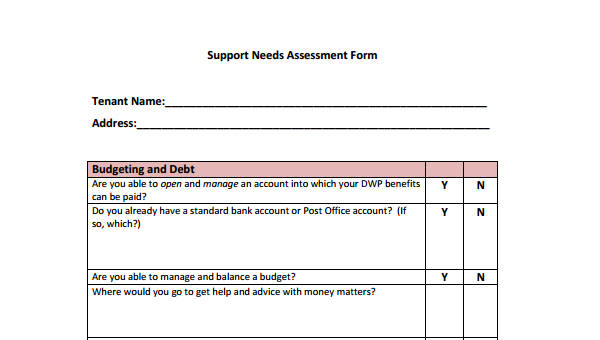

Free 31 Needs Assessment Forms In Pdf Excel Ms Word

Mortgage Interest And Your Taxes Green Bay Mortgage Lender

Mortgage Interest Statement Form 1098 What Is It Do You Need It

The Top Startups Of 2022 Wellfound Formerly Angellist Talent

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

Ex 99 1